Editor’s note

This month, we found ourselves at a pivotal juncture with the Indian general election results on June 4. Exit polls were well and truly trashed leading the country back, after a long time, into the era of coalition politics. Market volatility, which is always expected during such times went through the roof. The question, of course, remains how does all of this influence investor sentiments and what might be the best portfolio strategies?

Welcome to the inaugural issue of our monthly newsletter, AMPLIFY, designed to empower you as you navigate the intersecting worlds of wealth building and executive lifestyle. This is an election special issue as we look at the impact of the fractured verdict, and arm investors with not just the understanding of what happened but also introduce some technical concepts that will keep one in good stead during all kinds of volatile times.

In every issue, you will find the following sections, each covering an important aspect and benefit:

The World and Your Wallet - Here, our CIO, Karan Aggarwal, analyses how global events from the previous month with the potential to impact wealth creation, and expert advice on the course of action.

Primer - This section is dedicated to a crash course on critical technical aspects influencing your investment portfolio, ensuring you’re well-prepared to understand the market's ebb and flow in the context of your money.

Finer Club - This section updates you on the latest from the world of executive lifestyle - from essential business loyalty programs to life hacks for the elite traveller to innovative investment alternatives.

A Stock Story - Also launching this month is our very own podcast, ‘A stock story’, - which chronicles fascinating tales behind some of the most memorable stocks. Here, each month we will recap episodes from the previous month and the upcoming ones.

We increasingly live in a world full of butterfly effects, with each event capable of causing ripples that can impact the real value of our money. It is to this end that we aim to provide you with the knowledge and insights to make informed decisions. Happy reading, and happier investing!

Best regards,

In this issue

The World & Your Wallet - From the CIO’s desk

R.I.P. Exit Polls. There’s simply no other way to put it.

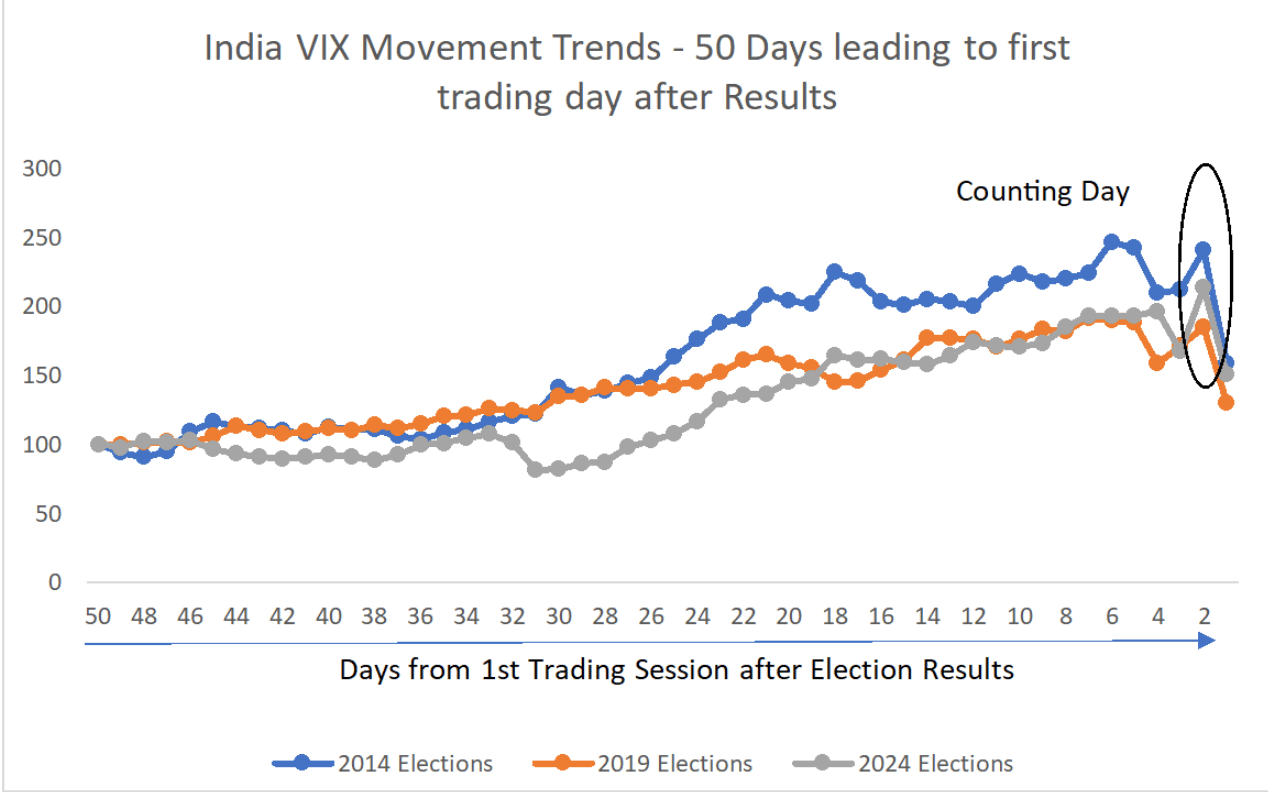

The thing is, the markets have not forgotten the scars of 2004 when a political surprise sent markets into a tailspin with nearly 2 lower circuits in 2 trading sessions following the results on May 13, 2004. Political risk became a regular feature in the election year as in 2014 and 2019, Nifty VIX (volatility gauge) spiked by 100% to account for sharply higher political risk in the 8 weeks leading to election results. And the people who traded on this fear and bought the market did make money. These, of course, are the ones who realise that the VIX levels cool off post-result day.

In 2024, VIX followed a similar trajectory rising from around 10 in 2nd week of March 2024 to around 25 on the last day of polling. Nifty 50 oscillated between a wide range of 21300 - 23500 (10% band) while scaling 4 new all-time highs during the volatile phase until result day.

However, it was 2004 redux this time with the spike in political risk. After 10 years of stability and political continuity, voters have given the fractured mandate and India is back to the era of coalition politics. Markets reacted wildly with VIX rising on election day from 18 to 31 and Nifty 50 and Bank Nifty saw intraday losses of nearly 8%.

However, there are some silver linings:-

Freebie politics and unsustainable job promises failed to fetch the desired results in Bihar, Karnataka, Telangana, and so on.

Mr. Modi is expected to return for 3rd time, albeit in a coalition avatar, ensuring policy continuity which led VIX to cool to levels of 18 again at the time of writing this article.

These silver linings calmed the market and ensured that volatility cooled after the election result as it happened in 2014 and 2019.

Macro trends

Moving from the election-tinted view to a more holistic one, we do have some positive things brewing.

While the consensus on the estimated GDP growth rate for FY 2023-24 was between 7.7%, in reality it turned out higher at 8.2%.

Fiscal deficet, on the other hand, which was targeted to be around 5.8% of GDP for FY 2023-24, in reality stood at 5.6%.

RBI gave a surprise dividend of INR 2 Lakh Crore which is expected to put the fiscal deficit below the coveted target of 5% by FY 2024-25, 1 year ahead of schedule.

Improvement in government finances led to rating upgrade with S&P upgrading the rating outlook for India to ‘Positive’ after 15 long years.

Add to this, prospects of the addition of Indian bonds to global benchmarks, we may see a 10% bounce in stock valuations (over a long-term P/E average of 23-24x) and a sharp decline in bond yields, thus triggering a rally in bonds and INR over the next 18 months. Considering the discount against the historical valuation of 10% and the conservative estimate of annual EPS growth for Nifty 50 companies at around 10% for the next fiscal year, these developments have the potential to deliver a 30% rally in the next 18 months from levels of 22000.

On the flip side

With election uncertainty in India, FIIs took out nearly INR 80,000 Crore and a big slice of it found its way to China with the Hang Seng Benchmark rising nearly 20% from mid-April to Mid-March. FII exodus meant Indian stocks could not participate in the global rally in May which saw most US and European benchmarks (S&P 500, NASDAQ, Dow, and DAX) scaling new all-time highs. China's recovery (23-month high manufacturing PMI and 10-month high services PMI) could unintentionally negatively impact global inflation, as major industrial metals such as Copper, Aluminum, and Nickel traded at 52-week highs in May. With US yield in the range of 4%-5% and PCE print staying at 2.8% (significantly above the Fed target rate of 2%), any rally in metals would end any possibility of a rate cut in 2024 without causing a recession in the US.

Investor takeouts

The 4th June stock market crash represents significant entry opportunities for long-term investors.

Many big names in the Banking, PSU, infrastructure, and manufacturing sectors are still trading at 5%-10% discount to their all-time highs seen on 3rd June 2024.

However, government formation and policy direction are still unclear at this stage, investors are advised to hedge political risk by diversifying into defensive and high-quality businesses in the FMCG, Pharma, and IT sectors.

Some allocation into the international market via China and US ETFs would also help in diversifying short-term political risks associated with India.

EleverFactors

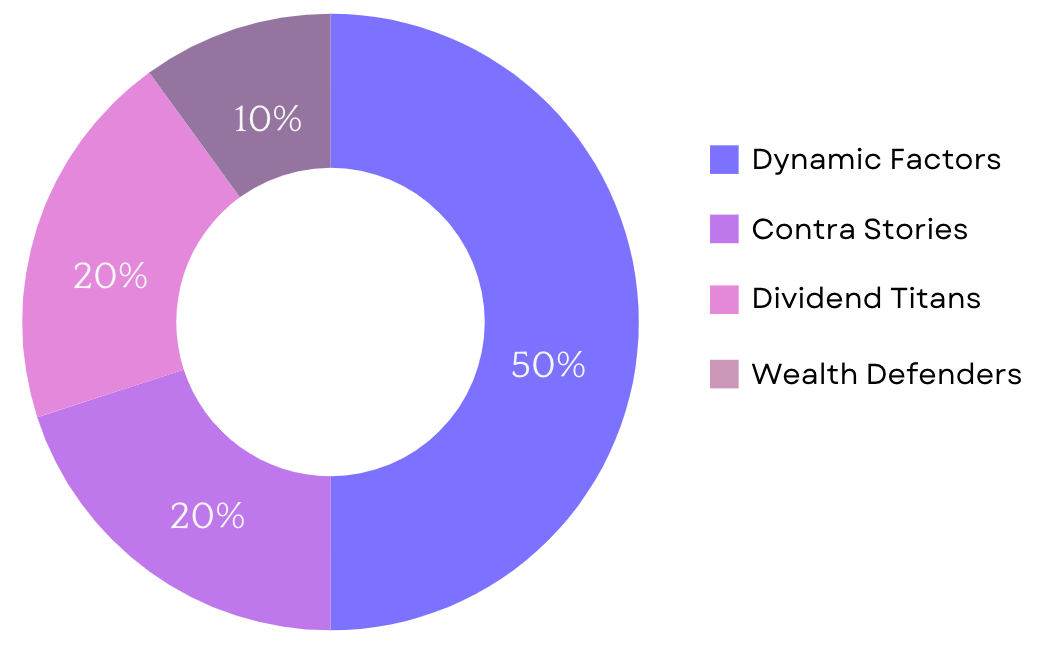

When it comes to EleverFactors, we recommend investors invest in weekly tranches spread over 3-4 weeks, with each tranch having a 50% allocation towards DynamicFactors while the remaining 50% is distributed among low-risk EleverFactors such as Dividend Titans, Contra Stories, and Wealth Defenders.

Though present DynamicFactors constituents are available at a deep discount as of June 4, there is widespread apprehension that with the heavy losses in this election, the priority of the relatively weaker NDA government would shift from Infrastructure and Development to Rural Income. In case of such a policy shift, diversification towards defensive and low-risk EleverFactors is expected to deliver short-term outperformance and provide a sufficient cushion during the period of slow recovery in DynamicFactors constituents to new all-time highs.

About EFs

EleverFactors are 10 equity strategies that we currently offer. In addition to this, we also offer a dynamic model called Dynamic Factors, which follows a tactical allocation strategy with automated rebalancing as per macro market signals.

Key highlights that separate our strategies from others are as below:

We are 100% rule-based, this in turn means we have 0% human bias. These rules are constantly monitored and refined by our investment team.

Our strategies are factor-based. This means our algorithms evaluate, select and manage portfolios by analysing underlying factors of a stock such as value, momentum, volatility, etc. This, again reduces bias by avoiding dependence on human-centered fundamental analysis of a stock.

Our Tactical overlay constantly monitors macro signals, allowing us to prepare well in advance for major market movements by triggering rebalancing alerts.

Know more about our strategies and their amazing past performance on our website at HERE.

Primer: Volatility

Investing in financial markets comes with a mix of opportunities and risks. One of the key factors that investors need to understand and manage is volatility. This guide will provide you with a bite-sized, easy-to-understand overview of what volatility is, how it impacts investment portfolios, and the best practices for managing it effectively to enhance your investment returns.

What exactly is it?

Volatility refers to the degree of variation in the price of a financial instrument over time. It measures the extent to which the price of an asset, such as a stock, bond, or commodity, fluctuates. High volatility means large price swings, while low volatility indicates more stable prices. Volatility is often quantified using statistical measures such as standard deviation or variance.

How does it impact an investment portfolio?

Volatility impacts an investment portfolio in several ways:

Risk: Higher volatility has a direct correlation to the risk of an investment portfolio. This is because the chance of an investment portfolio deviating from its expected return increases with the rise in its volatility.

Emotional Stress: Significant volatility will result in wide fluctuations in portfolio returns and in turn cause investors to make emotional decisions, such as selling in a panic during market drops, affecting the long-term performance of the portfolio.

Investment Horizon: Voalitilty also has a strong correlation with the investment horizon of an investment. A short-term investment should have lower volatility as the deviation in expected return because of higher volatility can be very difficult to correct. However, long-term investments can handle higher volatility as the markets are more likely to stabilise in time.

Cautionary tales of discounting volatility

Here are some historical examples where not accounting for volatility led to catastrophic outcomes for large portfolios:

Long-Term Capital Management (LTCM) Collapse (1998):

LTCM was a hedge fund that used high leverage and complex mathematical models to invest. They underestimated the volatility of the Russian financial crisis, leading to a loss of $4.6 billion in a few months and requiring a bailout by major banks to avoid a broader financial crisis.

Dot-com Bubble Burst (2000-2002):

Many large tech-focused mutual funds and portfolios heavily invested in Internet companies saw massive losses. The NASDAQ Composite Index fell nearly 78%, erasing billions of dollars in wealth. Investors who didn't account for the high volatility and speculative nature of tech stocks faced severe financial damage.

Global Financial Crisis (2007-2008):

Major financial institutions like Lehman Brothers, which held significant positions in mortgage-backed securities, failed to account for the volatility and risks in the housing market. This oversight led to the firm's bankruptcy and contributed to a market crash where the S&P 500 lost about 57% of its value, causing widespread losses across investment portfolios.

Volatility in action

For example, take the three hypothetical portfolios below. Portfolio (Scenario) A has the lowest volatility. In any given year, it never grows by more than 10% or loses more than 5% of its value. Over a 20-year period, Portfolio A grows by 55%. In contrast, Portfolio (Scenario) C is much more volatile. It achieves higher returns of 40% but also experiences greater losses (35% compared to only 5%). The net effect in this case is that Portfolio C gradually loses value over time.

The takeaway, which may be counter-intuitive, is that it’s better to have lower returns and lower volatility than higher returns paired with higher volatility when thinking long-term.

Credit: Farm together

Best practices for managing Volatility

Constructing a Portfolio:

Diversification: Spread investments across different asset classes (stocks, bonds, real estate, etc.) to reduce risk - a key measure to consider here is the correlation between asset classes. The lower the correlation, better the diversification and in turn lower is the portfolio volatility.

Asset Allocation: Balance between high-risk (stocks) and low-risk (bonds) assets according to your risk tolerance and investment horizon.

Managing a Portfolio:

Regular Rebalancing: Adjust the portfolio periodically to maintain the desired asset allocation.

Use of Hedging: Employ financial instruments such as options and futures to protect against significant losses.

Stay Informed: Keep up with market trends and economic indicators to make informed decisions.

In summary

Understanding and managing volatility is crucial for achieving a balanced risk-return profile in investment portfolios. By applying best practices, investors can enhance stability and achieve consistent growth.

Finer club

Investing in collectibles such as vintage cars, art, and other rare items can be a worthwhile strategy, but it's not without its challenges. Here’s a step-by-step guide to help you decide if this type of investment is right for you.

What are collectibles?

Collectibles are items that are considered valuable due to their rarity, historical significance, aesthetic appeal, or personal interest. These items are often sought after by collectors and investors for their potential to appreciate over time.

To qualify as an investment-worthy alternative, a collectible should meet at least one or more of the below criteria:

Rarity: Items that are rare or have limited production runs tend to be more valuable.

Historical Significance: Objects with historical or cultural importance often hold higher value.

Aesthetic Appeal: Items that are visually appealing or artistically significant can attract collectors.

Provenance: A well-documented history of ownership and origin can enhance value.

This type of investment can make sense for high-net-worth individuals who are looking to diversify their portfolios beyond traditional assets like stocks and bonds, and who have a passion for the items they collect. It is particularly appealing during times of economic uncertainty or high inflation, as collectibles often hold or increase in value when other investments falter. However, successful investing in collectibles requires significant expertise, careful due diligence, and a long-term perspective, making it best suited for those with the knowledge, financial resources, and patience to navigate this unique market.

Here’s a quick look at some of its pros & cons:

Pros | Cons |

|---|---|

Diversification | Expert Knowledge Required |

- Reduces overall portfolio risk. | - Requires deep market understanding. |

- Low correlation with traditional assets. | - Valuation can be complex and subjective. |

Appreciation Potential | High Costs |

- Potential for significant long-term returns. | - Expensive to acquire high-quality items. |

- Unique items often increase in value due to rarity. | - Maintenance and storage can be costly. |

Tangible Enjoyment | Liquidity Issues |

- Personal satisfaction and aesthetic pleasure. | - Harder to sell quickly compared to traditional investments. |

- Cultural and historical value. | - The market can be volatile and influenced by trends. |

Inflation Hedge | Potential for Fraud |

- Can preserve value during economic downturns. | - Susceptible to forgeries and counterfeits. |

- Often rises in value with inflation. | - Extensive due diligence is needed to verify authenticity. |

Legacy and Heritage | Market Trends and Fads |

- Can be passed down through generations. | - Value can be heavily influenced by current trends. |

- Items often carry sentimental and historical significance. | - Long-term sustainability of trends is uncertain. |

What does the data say?

Of course, none of it will mean anything if there isn’t strong historical evidence backed by data to suggest that collectibles as an asset could indeed make a sensible asset class to consider. So here’s what the data shows:

Category | Average Annual Return | Index/Source | Performance During Economic Downturns | Inflation Hedge Performance |

|---|---|---|---|---|

Fine Art | 7.6% - 8.9% | AMR Index, Mei Moses Art Index | 2008 Crisis: Slight decline & quick recovery | 2000-2010: Outperformed inflation, returns averaged 7-8% |

Vintage Cars | 13% | HAGI Top Index | 2008 Crisis: Stable, some models appreciated 15-20% annually | 2010-2020: Consistentlyoutperformed CPI, 13% return |

Coins | 10% | PCGS 3000 Index | 2008 Crisis: Stable to appreciated values | Historical data: Consistent performance during high inflation periods |

Wine | 10.2% | Liv-ex Fine Wine 1000 Index | 2008 Crisis: Minor declines, quick recovery | 2000-2010: Averaged 10.2%, outperforming inflation |

Overall | N/A (diverse returns) | Barclays Wealth Insights, Knight Frank's Wealth Report | Lower portfolio volatility, less correlated with market downturns | Diversification and tangible asset performance provide inflation protection |

A study by Barclays found that adding collectibles to an investment portfolio can reduce overall volatility. The Barclays Wealth Insights report highlights that ultra-high-net-worth individuals allocate, on average, about 9% of their portfolios to collectibles and other passion investments.

In summary

Investing in collectibles can be a rewarding way to diversify your portfolio and potentially achieve significant returns. However, it requires careful selection, thorough research, and often a passion for the items being collected. Each type of collectible offers unique advantages and challenges, making it important for investors to align their choices with their expertise, interests, and investment goals.

Podcast

This month we also launched our very own podcast. It’s called ‘A Stock Story’. Each episode uncovers the origins, triumphs, and trials of memorable stocks, revealing fascinating narratives that have shaped the financial world.

Our first episode chronicles one of India’s most beloved brands - “Maggi” and the lead controversy that shook it to the core.

This episode is a riveting tale of crisis management, brand resilience, and the power of consumer trust. Tune in to 'A Stock Story' and unravel the twists and turns of Maggi’s lead saga.

Stay tuned every Thursday morning at 08:00 for more fascinating stock stories. Coming up next month on ‘A Stock Story’:

Tata Motors: A rollicking 2-part episode about one of our home-grown automotive brands, from humble beginnings as a commercial vehicle manufacturer to the international forays owning iconic brands such as Jaguar and Land Rover.

Cola Wars: From fierce marketing battles to controversies and cultural impacts, join us as we explore how Coca-Cola and Pepsi have fought for dominance in one of the world's largest and most dynamic markets.

In closing

As we draw this inaugural issue of AMPLIFY to a close, we hope you feel more informed and empowered to navigate the complex interplay between wealth creation and lifestyle. We aim to arm you with insights and strategies that not only safeguard but also amplify your financial and personal growth.

Stay tuned for the next issue, where we will continue to bring you timely insights and valuable tips.

Happy reading, and happier investing!

Warm regards,

The AMPLIFY Team