Editor’s note

Welcome to the second issue of Amplify and we are already taking a step to improve our newsletter.

From this issue onwards, you will find a quick 2-minute audio capsule that summarizes the essence of this month’s newsletter. You can tune in for a quick snapshot and read the details at your leisure. Along with this, we have also added a 30-second survey to understand our readers’ preferences, so that going forward we can deliver more quality content that you like.

This month, our focus continues to be on the post-election result market movements. Without a single party majority, we have reentered the era of coalition politics, this in turn has realigned market focus from infrastructure to domestic consumption and export-oriented sectors. On the global front, high US equity valuations and Chinese real estate issues create challenges and opportunities.

Read on for more, or from this month onwards - listen in, too!

Best regards,

Table of Contents

Listen to a quick 2-minute snapshot of what you will find in this month’s newsletter below.

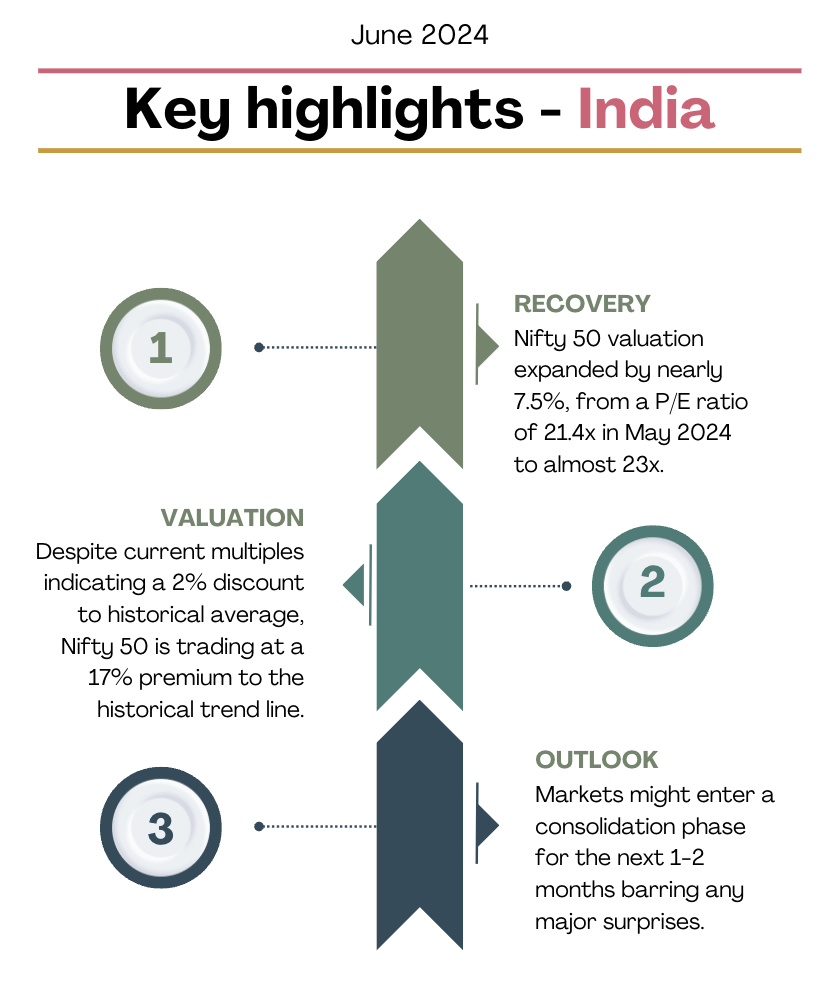

The World & Your Wallet

Since the new Modi 3.0 administration took office, market jitters have eased significantly. The VIX (fear gauge) has settled at 12-13, down from intraday highs of 30 on June 4. The Nifty 50 index has rebounded to new highs of 24,300, and broader markets have also shown resilience, with midcap and smallcap benchmarks trading 4%-5% higher than their pre-election peaks on June 3, 2024. Below is a snapshot of the key highlights from the past month.

Key highlights - India

Sectoral Breakdown

Moving beyond positive headline numbers, the sectoral breakdown of returns shows that India-centric political risk is still significantly high and investors are already accounting for it.

Swinging with the Political Winds

Till the evening of June 3, it was widely expected that the Modi government would return with a larger mandate which would provide public validation for the infra-led growth model and ensure the continuation of capex-driven policies.

As a result, sectors like PSU, PSU Banks, Infra, Power, Metal, and Energy delivered 20%-45% returns till June 3 on a YTD basis.

On the other hand, during the same period defensive and export-oriented sectors like IT, Private Banks, and FMCG delivered negative to low single-digit returns.

* Calculated using Nifty Sectoral Indices

However, on June 4, as BJP unexpectedly lost the single-party majority, there was a strong clamour among the party support base regarding delivering tax sop measures to middle-class taxpayers and some populist schemes.

As a result, recovery from 4th June lows was led by sectors linked to domestic private consumption (Automobile, FMCG), export-oriented sectors (IT, Pharma), and safe segments (Private Banks).

In the same period, pre-election favourites in PSU and Infra sectors underperformed and remained below June 3 highs with negative to near zero returns.

Looking Ahead

The NDA government’s upcoming budget on July 24 is anticipated to provide clearer policy directions for the next five years, influencing market trends and sector performance.

Key Highlights - Global

Market Performance and Economic Indicators:

US Market Rally: Anticipating two interest rate cuts by December 2024 has driven the S&P 500 above 5500 and NASDAQ 100 above 20,000.

Contradictory Signals: Despite equity market highs, the US Dollar Index remains above 105, and the US 10-year yield hovers around 4.50%, indicating scepticism in bond and currency markets about the rate cuts.

Valuation Concerns

High Valuations: The S&P 500 P/E ratio is significantly above its 5-year average, possibly entering bubble territory seen last in the late 1990s.

Potential Risks: Current valuations, even with a 10% EPS growth, suggest the market could be prone to sharp corrections on negative news.

* Data for Constituent of SPY ETF is used as proxy for S&P 500 companies

Impact on Global Markets:

Nifty 50 Outlook: High US equity valuations may hinder Nifty 50’s progress towards 25,000 by year-end.

Chinese Real Estate Crisis

Performance since Dec 2013 - Hang Seng vs S&P GSCI Industrial Metal Index

Downturn: Chinese housing prices have fallen for 12 consecutive months, the biggest drop since 2015 in June.

Economic output: The ongoing meltdown in this sector, which accounts for 25% of China's economic output, is notable.

Opportunities for India: Reduced Chinese demand for industrial metals might lower infrastructure costs for India, supporting its $10 trillion investment goal by 2030.

Investor Points to Ponder

Modi 3.0 administration's reduced majority shifted market recovery from infrastructure to domestic consumption and export-oriented sectors.

Though market valuations align with historical trends, markets might take a short breather before the next bull run phase.

High US equity market valuations and Chinese real estate troubles present risks and opportunities for India's growth.

The upcoming NDA budget on July 24th is crucial for setting future policy directions.

EleverFactors

Looking at global headwinds and because policy direction for the next 5 years would be outlined in the Budget to be presented in July 2024, we recommend investors prepare for a short consolidation phase before the next round of bullish run

We recommend investors keep a 50% allocation towards Dynamic Fators in line with medium-term and long-term bullish sentiment while distributing the remaining 50% among Contra Stories, Dividend Titans and Low-Vol Shields to protect against short-term headwinds and negative surprises.

Quick feedback

We endeavour to improve our content in every way. To this end, we request you to take a super quick 30-second survey. It will be of great help in helping us bring quality content that matters to you.

Take the Survey HERE.

Primer

Sector Rotation

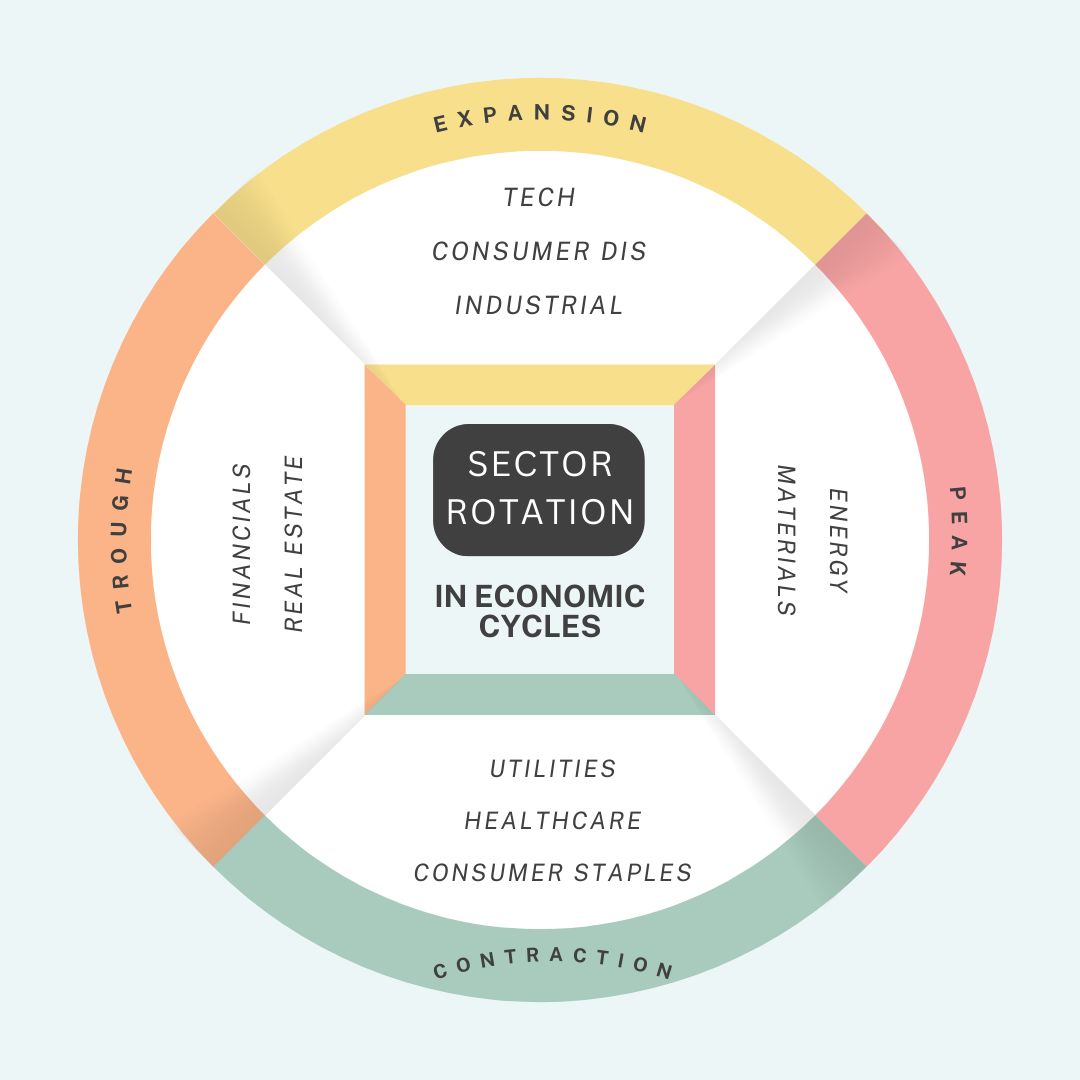

Investing can be like riding a roller coaster. The markets go up and down, often influenced by different sectors performing well or poorly. One strategy that savvy investors use to make the most of these market movements is called "sector rotation." Let's break it down, explore why it's crucial, and how you can implement it in your investment portfolio.

SECTOR ROTATION is the practice of shifting investments between different sectors of the economy based on the phases of the economic cycle. The idea is to move your money into sectors expected to perform well in the current phase of the economy while moving out of those likely to underperform.For instance, during an economic expansion, consumer discretionary and technology stocks might thrive as people have more disposable income and businesses invest in new technologies. Conversely, during a recession, utility and healthcare stocks might perform better as they provide essential services that people need regardless of the economic situation.

Why is it important?

Sector rotation is important because not all sectors perform well at the same time. The performance of different sectors fluctuates based on economic conditions, interest rates, and other factors. By strategically rotating sectors, investors can:

Maximize Returns: Invest in sectors that are poised to outperform.

Minimize Risks: Avoid sectors that are likely to underperform.

Diversify Portfolio: Spread investments across various sectors to reduce risk.

Case study: The impact of Sector Rotation

Theories are well and good, but here’s an example of how Sector Rotation might impact your investments.

Period | Nifty 50 | Sector Rotation (Nifty IT + Nifty Infra) | Nifty IT | Nifty Infra | Allocation |

|---|---|---|---|---|---|

May 2014 - Dec 2020 | 11.94% | 18.66% | 18.66% | 3.86% | Nifty IT (100%) |

Dec 2020 - Apr 2022 | 17.56% | 28.04% | 23.95% | 31.08% | Nifty IT (50%) + Nifty Infra (50%) |

Apr 2022 - May 2024 | 14.95% | 29.72% | 3.45% | 29.72% | Nifty Infra (100%) |

The explanation

From May 2014 to December 2020, an investor who practised sector rotation achieved impressive results with an 18.66% return in the Nifty IT sector, compared to the Nifty 50 index's 12% return during the same period.

Similarly, by diversifying their portfolio equally (50%) between Nifty IT and Nifty Infrastructure from December 2020 to April 2022, the investor's overall return soared to around 28%, significantly outperforming the Nifty 50's 17.56% return.

Continuing this strategy, the investor rotated back into Nifty Infrastructure between April 2022 and May 2024, resulting in a remarkable 29.72% return, while the Nifty 50 only achieved a 15% return.

In summary, this data highlights how an investor using a sector rotation strategy between Nifty IT and Nifty Infrastructure outperformed the Nifty 50 index across three distinct periods.

The key, however, lies in selecting and minutely tracking the indicators that suggest the sectors with chances of outperformance at any given time.

A step-by-step guide to implementing Sector Rotation

Understand the Economic Cycle: Familiarize yourself with the phases of the economic cycle: expansion, peak, contraction, and trough. Various economic indicators, such as GDP growth rates, employment rates, and consumer confidence indexes, can help you identify these phases.

Identify Sector Sensitivities: Recognize which sectors perform well in different economic phases - refer below.

Monitor Economic Indicators: Regularly review economic data and forecasts. Pay attention to changes in interest rates, inflation, and other key indicators.

Review and Adjust Portfolio: Periodically review your portfolio. Shift investments into sectors that are expected to perform well in the current and upcoming phases of the economic cycle.

Stay Informed: Keep up with financial news, market trends, and expert analyses. Use resources like economic reports, financial news websites, and investment newsletters.

Consult a Financial Expert: If you're unsure about making these adjustments yourself, consider consulting a financial expert who can provide personalized advice and help you implement a sector rotation strategy effectively.

Conclusion

Sector rotation is a powerful strategy that can help you navigate the ups and downs of the market more effectively. By understanding economic cycles and shifting your investments accordingly, you can potentially maximize returns and minimize risks.

Finer Club - Venture Funds as an asset class

What is Venture Fund investing?

Venture fund investing involves providing capital to early-stage startups and companies with high growth potential. Funds focused on seed funding typically make initial investments to help a company develop its product and gain traction. On the other hand, growth stage driven funds, usually invest in later-stage investments aimed at scaling the business.

How It Differs from Traditional Investments

Risk and Reward Profile: Seed and venture investments are inherently riskier than traditional investments like stocks or bonds due to the higher chance of business failure. However, they also offer the potential for substantial returns if the company succeeds.

Illiquidity: These investments are usually locked up for at least some or several years until the company exits via an acquisition or IPO, making them less liquid than publicly traded assets.

Active Involvement: Investors can often take an active role in advising and mentoring startups, unlike the more passive nature of investing in public equities or bonds.

Who should consider Venture Fund Investing?

This investing style is generally suited for high-net-worth individuals with a higher risk tolerance and a longer investment horizon. It can make sense as a part of an overall investment portfolio for those looking to diversify beyond traditional asset classes and are interested in the potential for high returns.

Pros & cons of Seed & Venture Fund investing

PROS | CONS |

|---|---|

Potential for high returns | High risk of total loss |

Access to innovative startups | Illiquid investments |

Active involvement and mentoring | Long investment horizon |

Diversification from traditional assets | Requires significant due diligence |

Support for entrepreneurship | High minimum investment requirements |

What does the data say about its performance?

According to the Indian Private Equity and Venture Capital Association (IVCA), the average internal rate of return (IRR) for Indian venture capital funds from 2010 to 2020 was approximately 18-20%. This is notably higher than the average return from traditional investment avenues like the Bombay Stock Exchange (BSE) Sensex, which averaged around 10-12% annually over the same period.

Significant Exits:

Flipkart: Early investors like Accel Partners saw returns upwards of 700% when Walmart acquired a majority stake in Flipkart for $16 billion in 2018.

Zomato: Info Edge invested approximately $1 million in Zomato in its early stages. When Zomato went public in 2021, Info Edge's stake was valued at over $1 billion.

Ola: Tiger Global, one of the early investors, has seen significant gains as Ola's valuation surged to over $6 billion.

Best practices for Seed & Venture Fund investing

Conduct Thorough Due Diligence: Research the fund managers and the companies they invest in. Look at their track records, the viability of their business models, and market potential.

Diversify Investments: Spread investments across multiple funds to mitigate risk.

Understand the Risks: Be fully aware of the high risk and illiquidity involved in these investments.

Seek Professional Advice: Consult with financial advisors or professionals who specialize in venture investing to make informed decisions.

Be Prepared for Long-Term Commitment: These investments typically require a long-term horizon, often 5-10 years, before realizing returns.

Active Involvement: Engage with the startups, offering advice and support where possible to increase the chances of success.

In conclusion

Investing in seed and venture funds can be a lucrative opportunity for high-net-worth individuals willing to accept the higher risks and longer time horizons. By following best practices and staying informed, investors can potentially achieve substantial returns while contributing to the growth and innovation of emerging businesses in India.